More than 5.3 borrowers are at risk of garnishment, other actions

May 5, 2025

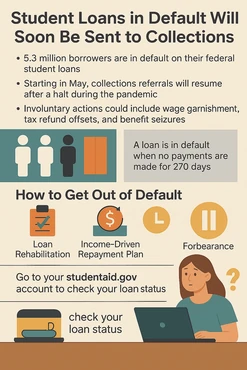

- More than 5.3 million borrowers are at risk of wage garnishment as collections resume after a pandemic pause.

- Borrowers in default will soon receive notices about involuntary collection actions starting May 5

- Options remain for borrowers to rehabilitate loans or avoid collections, but time is running out.

The Education Department today (May 5) begins referring student loans that are in default to collections, ending a more than four-year pause that began during the COVID-19 pandemic.

The move affects roughly 5.3 million borrowers who have fallen into default on their federal student loans and now face severe consequences, including wage garnishment, tax refund interception, and seizure of Social Security payments. The pause on collections, first implemented in March 2020, was extended multiple times by the Biden administration but officially ended last October.

The move affects roughly 5.3 million borrowers who have fallen into default on their federal student loans and now face severe consequences, including wage garnishment, tax refund interception, and seizure of Social Security payments. The pause on collections, first implemented in March 2020, was extended multiple times by the Biden administration but officially ended last October.

I wanted to throw up because I already live paycheck to paycheck, said Kat Hanchon, 33, who owes nearly $85,000 in student loans from undergraduate and graduate degrees, in an Associated Press report. Hanchon, who works in higher education IT, said shes struggled even with an income-driven repayment plan and has not been able to make payments since late last year.

The department will soon begin sending out notices informing borrowers of upcoming collection efforts, which are scheduled to begin on May 5 through the Treasury Departments offset program.

Understanding default and what happens next

Student loans become delinquent when payments are missed for 90 days, and after 270 days of nonpayment, loans officially go into default. Default can severely damage a borrower’s credit and trigger aggressive collection actions.

The Education Department advises borrowers to check their loan status via studentaid.gov and to update their contact information to ensure they receive important notices.

Paths out of default

Options for borrowers include:

-

Loan rehabilitation, where borrowers make nine consecutive monthly payments to restore their loans to good standing.

-

Income-driven repayment plans, which adjust monthly payments based on income and family size.

-

Forbearance for delinquent borrowers (not those already in default).

Experts emphasize acting quickly. Loan rehabilitation is a strong option, but it can only be done once, said Betsy Mayotte of The Institute for Student Loan Advisors.

Looking ahead

With collections set to resume imminently, millions face financial strain if they dont take swift action. Borrowers are urged to explore their repayment and rehabilitation options to avoid the harshest penalties.

Newsletter

Sign up below for The Daily Consumer, our newsletter on the latest consumer news, including recalls, scams, lawsuits and more.

.newsletter-form {

display: flex;

max-width: 400px;

margin: 20px auto;

background: #f8f9fa;

padding: 10px;

border-radius: 8px;

box-shadow: 0 4px 6px rgba(0, 0, 0, 0.1);

}

.newsletter-input {

flex: 1;

padding: 10px;

border: 1px solid #ccc;

border-radius: 5px 0 0 5px;

font-size: 16px;

outline: none;

}

.newsletter-input:focus {

border-color: #007bff;

}

.newsletter-button {

background: #2976D1;

color: white;

border: none;

padding: 10px 15px;

font-size: 16px;

border-radius: 0 5px 5px 0;

cursor: pointer;

transition: background 0.3s ease;

}

.newsletter-button:hover {

background: #0056b3;

}

#Millions #borrowers #face #collections #student #loan #default #referrals #resume