In the aftermath of wildfires, when families are left sifting through ashes and trying to rebuild their lives, the true quality of an insurance policy comes sharply into focus. Too often, we hear from policyholders who thought they were adequately insured. Then they file a claim and learn that their policy does not fully pay for the loss.

They are shocked to learn that what they believed to be comprehensive protection turns out to be riddled with limitations, exclusions, and fine print that benefits the insurer far more than the insured. This disconnect is a direct result of the widespread misconception that all insurance is the same, a commodity differentiated only by price. That belief is not only wrong; it is dangerous.

There is a reason why some insurance policies cost less. It’s not because the insurer has found a magical way to provide the same benefits more efficiently. It’s because they are offering less coverage, less flexibility, less support, and often less of a moral commitment to stand by the policyholder when disaster strikes. The difference is not always visible in a quote comparison, but it becomes painfully clear when a claim is filed and denied or underpaid based on narrowly worded endorsements or hidden exclusions.

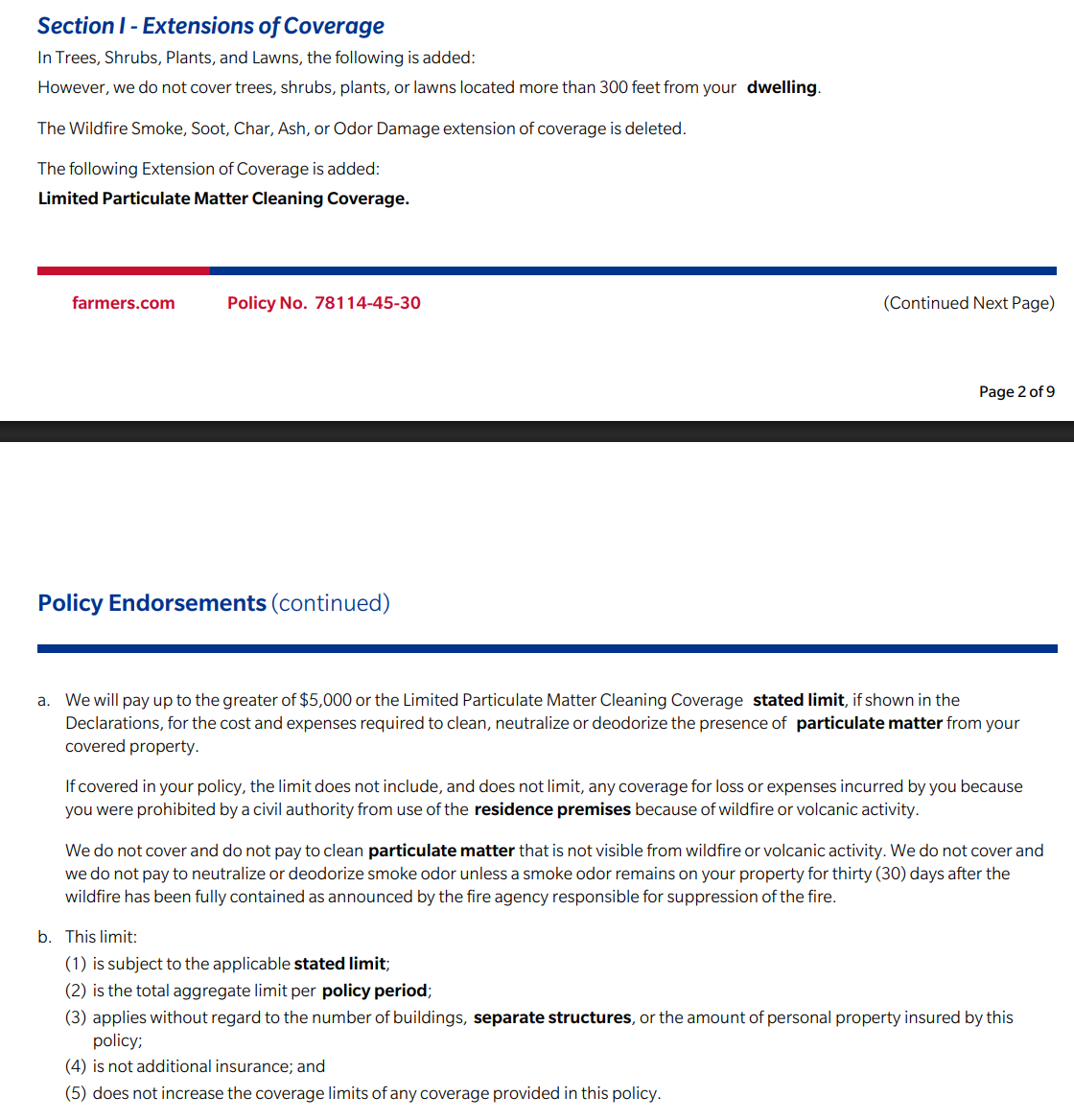

I have previously written about the flaws in Farmers Smart Plan insurance and its alarming contribution to the growing protection gap in property insurance in “The Protection Gap in Property Insurance—Why Nobody Should Buy Farmers Smart Plan Insurance.” Unfortunately, recent policy endorsements, such as the so-called Limited Particulate Matter Cleaning Coverage, underscore just how deeply this problem runs. These endorsements often appear benign or even beneficial at first glance, but in reality, they replace broader protections with more restrictive terms. In some cases, they limit coverage to such a degree that the policy offers little real help after a wildfire. For instance, when coverage for wildfire smoke, ash, and soot damage is capped, subject to visibility requirements, or even excluded entirely unless odors persist for 30 days, the promise of financial recovery becomes an illusion.

Buying insurance should never be a race to the bottom. The stakes are too high. A home is often the largest asset a person owns, and insurance is supposed to be the safety net that protects it. When that safety net is built with cut-rate materials, it fails precisely when it is needed most. Consumers deserve better than to be sold stripped-down policies disguised as smart savings. They deserve honesty, clarity, and coverage that will stand the test of disaster.

The truth is, not all insurance companies write policies with the same intention. Some design policies to protect policyholders. Others design policies to protect profits. When shopping for insurance, the question should never be “What’s the cheapest option?” but “Who will be there for me when it matters most?” The answer often lies not in the premium, but in the principles behind the policy. And when it comes to companies like Farmers, the warning signs are too many to ignore.

Insurance regulators need to be aware that small wording changes significantly change benefits under the policy. They should be aware that changes such as the one Farmers has made will reduce the amount of coverage policyholders have received for fire losses for over 100 years. Yet, these endorsements and changes continue to be approved because insurers do not fully explain the change and its full impact on the endorsement. Insurers like Farmers gain a market advantage by providing less coverage and expanding protection gaps. This needs to be addressed.

Thought For The Day

“Be a yardstick of quality. Some people aren’t used to an environment where excellence is expected.”

Steve Jobs

#Farmers #Smart #Plan #Endorsements #Property #Insurance #Coverage #Law #Blog