Direct bank checking account satisfaction rose 4 points from 2024

May 1, 2025

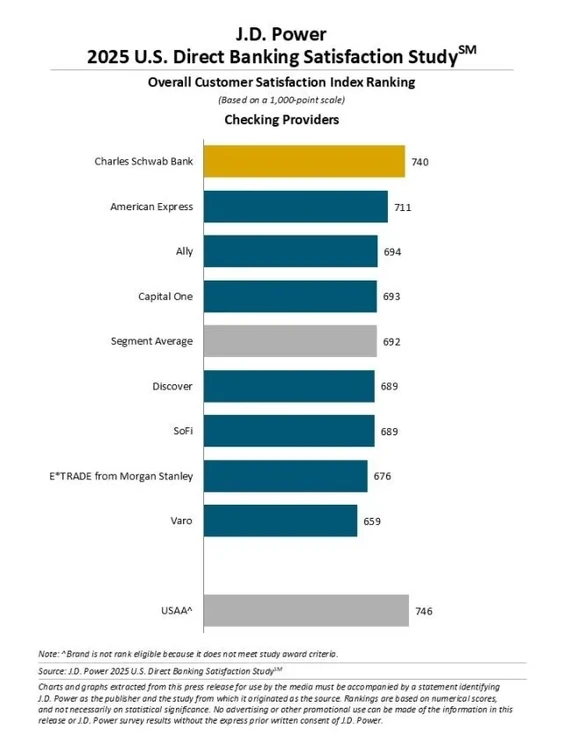

- Direct banks checking and savings accounts rated far higher in satisfaction than regional and national banks

- Support during tough times and superior digital experiences drive higher customer loyalty

- Charles Schwab Bank, American Express, and Ally top the rankings for customer satisfaction

In a competitive banking landscape, direct banksthose without physical branchesare outperforming traditional retail banks in both customer satisfaction and perceived support, according to the newly released J.D. Power 2025 U.S. Direct Banking Satisfaction Study.

In a competitive banking landscape, direct banksthose without physical branchesare outperforming traditional retail banks in both customer satisfaction and perceived support, according to the newly released J.D. Power 2025 U.S. Direct Banking Satisfaction Study.

The study reveals that direct bank checking accounts scored 692 out of 1,000 points, surpassing regional banks by 24 points and national banks by 35 points. Savings accounts performed even better, achieving an average score of 705, a whopping 89 points higher than regional banks and 98 points higher than national banks.

Direct banks excel by making customers feel genuinely supported, especially during difficult times, said Paul McAdam, senior director of banking and payments intelligence at J.D. Power. They deliver exceptional digital experiences, accessible customer service, and clear communicationcreating trust and satisfaction that traditional banks often struggle to match.

Key findings highlight customer priorities

-

Checking Satisfaction Climbs: Direct bank checking account satisfaction rose 4 points from 2024, while savings satisfaction dipped slightly by 5 points but remains far ahead of traditional rivals.

-

Support Is Crucial: Banks that excel at supporting customers during challenging times saw a 73-point boost in checking satisfaction and an 84-point lift in savings satisfaction.

-

Younger Generations Feel the Love: Gen Z and Gen Y customers reported the highest year-over-year increases in perceived bank support, while Boomers noted a decline.

The study also found that when customers feel well-supported, they are more likely to increase their use of direct deposit, open investment accounts, and hold credit cardsand are less likely to move their deposits elsewhere.

Top performers: Schwab, AmEx, Ally

For the seventh consecutive year, Charles Schwab Bank claimed the top spot for overall satisfaction in checking accounts with a score of 740. American Express (711) and Ally (694) rounded out the top three.

In the savings account category, Charles Schwab Bank again led the way with a score of 748, followed by American Express (737) and Marcus by Goldman Sachs (735).

Digital-first wins over customers

The study highlights that direct banksdefined as branchless institutions regulated by federal banking authoritiesare winning over customers by focusing on six key dimensions: customer service, ease of moving money, helping customers grow money, trust, and mobile and web account management.

Based on nearly 9,400 customer responses collected between December 2024 and March 2025, the findings reaffirm that digital-first banking models can not only compete with but also outperform brick-and-mortar institutions when it comes to customer loyalty and satisfaction.

#Direct #banks #outshine #traditional #rivals #J.D #Power #finds