Concerns about consumer debt are mounting as Trump tariffs threaten price pressures

May 8, 2025

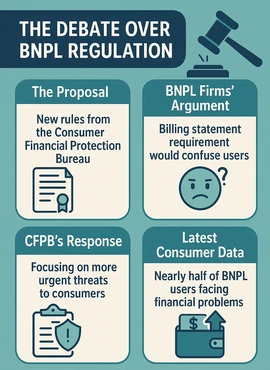

- The Consumer Financial Protection Bureau (CFPB) may rescind proposed rules treating Buy Now, Pay Later (BNPL) services like credit cards, citing resource constraints and other regulatory priorities.

-

BNPL leaders like Affirm argue that billing statement requirements create confusion and friction for users unfamiliar with traditional credit models.

-

A new Bankrate survey shows nearly 50% of BNPL users have experienced financial trouble from using these services, with missed payments rising amid growing usage for essentials.

The regulatory future of the booming Buy Now, Pay Later (BNPL) industry is once again in flux, as the Consumer Financial Protection Bureau (CFPB) signals a potential retreat from new rules aimed at aligning BNPL with traditional credit card protections.

Major BNPL providers including Affirm have strongly opposed the CFPBs push to require billing statements and other disclosures typically associated with revolving credit lines.

Major BNPL providers including Affirm have strongly opposed the CFPBs push to require billing statements and other disclosures typically associated with revolving credit lines.

In a formal response, Affirm argued that imposing credit card-style regulations would create compliance challenges and confusing outcomes for consumers, urging the agency to adopt frameworks more in tune with how BNPL products are actually used.

The controversy centers on a CFPB interpretive rule issued earlier this year, which the Financial Technology Association a trade group representing Affirm, Klarna, and other BNPL companies claims unlawfully redefined the regulatory landscape without going through the formal rulemaking process. The association filed a lawsuit in October challenging the rules legality.

More “pressing threats”

As regulators weigh their next move, the CFPB has floated the idea of rescinding the rule entirely, saying it needs to concentrate on more pressing threats to consumers, especially vulnerable groups like service members, veterans, and small businesses.

Yet consumer concerns about BNPL continue to grow. A Bankrate survey released Monday found that nearly half of BNPL users reported experiencing financial issues due to these services. With usage surging for basic necessities such as groceries, delinquencies are increasing a red flag for regulators and lenders alike.

“BNPL can be a good deal if you use it responsibly. It provides access to credit and can help users smooth out their cash flow” said Ted Rossman, senior industry analyst for Bankrate.”But sometimes it can lead to overspending, and you would have been better off waiting until you could pay for the item upfront.”

The CFPBs evolving stance and the markets growing risks come at a critical time. Affirm is set to report quarterly earnings Thursday, while Klarna, which has plans to go public, recently delayed its IPO amid volatility tied to President Trumps new round of global tariffs.

The fate of the CFPBs BNPL rule and the industry’s future regulatory landscape could ultimately reshape how millions of Americans shop, borrow, and budget in an economy increasingly reliant on flexible payment options.

Sign up below for The Daily Consumer, our newsletter on the latest consumer news, including recalls, scams, lawsuits and more.

.newsletter-form {

display: flex;

max-width: 400px;

margin: 20px auto;

background: #f8f9fa;

padding: 10px;

border-radius: 8px;

box-shadow: 0 4px 6px rgba(0, 0, 0, 0.1);

}

.newsletter-input {

flex: 1;

padding: 10px;

border: 1px solid #ccc;

border-radius: 5px 0 0 5px;

font-size: 16px;

outline: none;

}

.newsletter-input:focus {

border-color: #007bff;

}

.newsletter-button {

background: #2976D1;

color: white;

border: none;

padding: 10px 15px;

font-size: 16px;

border-radius: 0 5px 5px 0;

cursor: pointer;

transition: background 0.3s ease;

}

.newsletter-button:hover {

background: #0056b3;

}

#Buy #Pay #firms #push #consumer #protection #rules