Dips of 150+ points can derail major life events

May 27, 2025

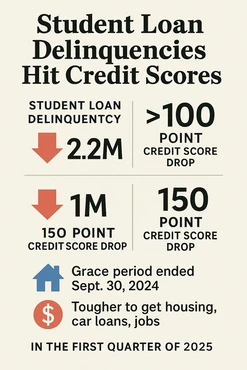

- Over 2.2 million borrowers saw 100+ point credit score drops due to resumed student loan payments.

-

More than 1 million Americans lost 150+ points, often enough to derail access to housing, cars, and jobs.

-

Grace period ended Sept. 30, catching many off guard especially those who didnt receive billing notices.

A crisis in credit

Millions of Americans are now grappling with sudden and dramatic credit score declines due to missed federal student loan payments a consequence of the end of pandemic-era relief measures.

In the first three months of 2025 alone, over 2.2 million borrowers saw their scores fall by more than 100 points, while over 1 million lost at least 150 points, according to a sobering new report from the Federal Reserve Bank of New York.

That scale of the decline is comparable to a bankruptcy filing, and could lock borrowers out of essential financial tools like auto loans, mortgages, and even insurance or job opportunities. Roughly 2.4 million of those affected previously had creditworthy profiles, eligible for mainstream lending products before the delinquencies hit their records.

Caught off guard

While the Department of Education promised clear communication before payments resumed, many borrowers report being blindsided. One such borrower, Tina Johnson, 44, from rural Kentucky, saw her credit score plummet from 650 to 418 after she missed just $440 in payments she wasnt aware were due, the Washington Post reported.

Nothing, no email, no phone call, no letter I couldve avoided all this if I had known, said Johnson.

The consequences were immediate and severe: the preapproved auto loan Johnson needed to replace her aging Nissan was revoked, doubling her monthly payment from $350 to nearly $700 and making it unaffordable. Shes now delaying critical home repairs and putting plans for a bachelors degree on hold.

Rejection rates on the rise

The credit score shock comes at an especially vulnerable time for consumers, as interest rates remain near 20-year highs and the Federal Reserve signals no immediate cuts. Lending has already begun to tighten:

-

Auto loan denials are increasing.

-

Credit card and mortgage refinancing rejections rose in February, year over year.

With borrowing already expensive, a damaged credit score only compounds the cost pushing some Americans further away from financial stability just as the economy begins to soften.

Pandemic pause comes to an end

Student loan payments were originally paused in March 2020 under emergency COVID-19 relief. Though repayments officially resumed in late 2023, the Biden administration offered a 12-month grace period where missed payments wouldnt affect credit. That grace period ended on Sept. 30, 2024 and millions have still not resumed payments.

Now, those delays are showing up as delinquencies in credit reports, with little recourse for affected borrowers. Advocates warn of long-term consequences if the administration doesnt offer further flexibility or communicate more effectively.

A financial cliff with no warning signs

For many, the damage is already done not by reckless spending, but by bureaucratic lapses and unclear guidance. As millions find themselves unexpectedly shut out of the credit system, the ripple effects are likely to grow.

#Student #loan #delinquencies #trigger #massive #credit #score #drop #millions