Multifamily and Data Centers Anchor Activity in a Cautious Market

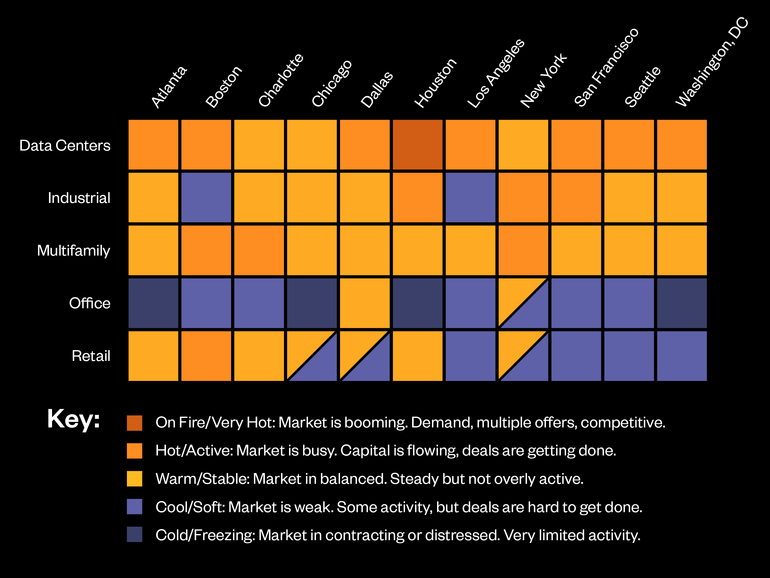

Seyfarth’s real estate team provides a bird’s-eye view of the current state of commercial real estate throughout the country—highlighting which markets and major asset types are active, slowing down, or experiencing shifts.

Seyfarth’s Take: What to Know

? Opportunities: Data centers remain in demand in markets like Atlanta, Los Angeles, and Washington, DC; Multifamily shows continued strength nationwide, supported by renter demand, zoning reforms, and limited new supply.

? Challenges: Office remains under pressure, with demand concentrated in Class A space; Tariff concerns, interest rate volatility, and policy shifts are fueling investor caution in markets like Houston, Dallas, and Seattle.

? Market Trend: Growing uncertainty around tariffs is creating new volatility for supply chains, development costs, and investment strategies.

Regional Rundown

“Atlanta continues to see most of its activity related to data center projects. The office segment remains slow, although leasing of Class A, amenity-rich assets is experiencing positive activity. Despite some weariness due to economic uncertainty, the industrial, multifamily, and retail markets appear stable. Reductions in deliveries and pipeline are assisting with that stability in the industrial and multifamily segments.” Kwame Benjamin, Partner

“Multifamily remains attractive in Boston amid high demand, limited inventory, and new opportunities from the MBTA Communities Act, which requires towns to expand zoning for more as-of-right multifamily housing development.” Eric Greenberg, Partner and Catherine Burns, Partner

“Charlotte remains steady with solid momentum in industrial, multifamily, and specific retail submarkets.” Eric Sidman, Partner

“Institutional capital continues to approach Chicago with discipline, not urgency, given continued interest rate uncertainty. Multifamily and industrial remain reliable performers, with retail showing signs of optimism, but the focus has shifted to asset quality and lease durability. For investors with patient capital and a long view, this market still offers compelling entry points.” Michael Merar, Partner and Tobi Pinsky, Partner

“The Dallas market appears steady, but the impact of tariffs and other market factors remains uncertain.” Amy Simpson, Partner

“The Houston market is grappling with uncertainty tied to proposed tariffs and geopolitical tensions in the Middle East. Elevated interest rates and policy shifts in Washington—including reduced tax incentives for renewable energy—are also weighing on sentiment, particularly in the office sector.” Peter Oxman, Partner

“Data centers remain strong in Los Angeles, while industrial activity is uneven and slowed by tariff concerns. Retail is sluggish, office shows some distress-driven and submarket-specific activity, and multifamily has improving fundamentals but ongoing affordability and development challenges.” Tim Farahnik, Partner and Stacy Paek, Partner

“In New York, investor and tenant demand continues to gravitate toward top-tier assets. Well-located luxury multifamily, high-end retail, and Class A office properties are seeing the most traction, while outdated office stock and underperforming retail are being left behind. Last-mile industrial and rental activity is healthy, especially in dense, supply-constrained areas. Deals continue to require a hyper-local lens.” Miles Borden, Partner and Cynthia Mitchell, Partner

“The San Francisco market is showing resilience, with Class A office rents remaining stable and data center development on the rise.” Robin Freeman, Partner

“The industrial and multifamily sectors in Seattle continue to show positive absorption and steady or rising rents. Office vacancies remain high, retail is facing headwinds from inflation and tariffs, and while data center demand is reported as growing, new project activity appears uneven on the ground.” Jami Balint, Partner

“The Washington, DC Metro Area is feeling the impact of federal layoffs and continued inflation, but data centers remain a bright spot. Multifamily has been holding steady as many workers look to rent rather than buy in an uncertain housing market.” James O’Brien, Partner

About Seyfarth’s Real Estate Team

Recognized as one of the largest real estate practices in the US, we have built an integrated team that serves local, regional, and national clients on the acquisition, financing, development, leasing, restructuring, servicing, and disposition of noteworthy real estate assets and portfolios. This experience extends across comprehensive array of asset classes, including office, industrial, multifamily, retail, health care, and data center projects. Learn more about our Real Estate practice.

#Real #Estate #Market #Pulse #July