Consumer advocates had warned the plan would push many Americans into poverty

June 3, 2025

-

Federal plan to collect defaulted student loans from seniors Social Security benefits paused after backlash

-

Advocates warn resuming offsets without reforms could push vulnerable Americans into poverty

-

Consumer groups urge permanent protections tied to poverty thresholds and fair repayment limits

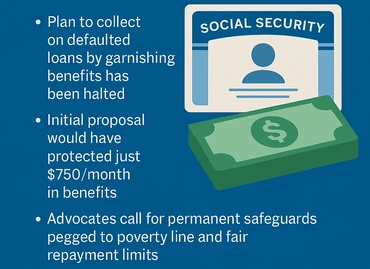

The U.S. Department of Education has announced it will pause plans to seize Social Security benefits from borrowers who have defaulted on federal student loans, following sharp criticism from advocates for older adults and people with disabilities.

In April, the department said it would begin garnishing benefits as early as Juneabandoning a Biden-era safeguard that protected the first 150% of the Federal Poverty Line (roughly $1,900/month) from seizure. Instead, it proposed reverting to a 1996 rule that protects only the first $750/month in Social Security incomean amount far below todays poverty line.

But in a statement released Monday night, a department spokesperson clarified that no Social Security benefits have been offset, and that any future collections from benefits are paused indefinitely.

Consumer advocates react

We are pleased to see the Department act to protect struggling older adults and people with disabilities who rely on Social Security to make ends meet, said Abby Shafroth, co-director of advocacy at the National Consumer Law Center (NCLC), in a news release. Seizing money from Social Security benefits would have pushed many people already living on tight budgets into poverty.

Consumer groups are urging the administration to go further by formally ending the use of offsets and reinstating income-based protections. A joint fact sheet released by NCLC and the New America Foundation recommends:

-

Permanently protecting at least 150% of the Federal Poverty Line in benefits

-

Capping loan collections at levels similar to income-driven repayment (IDR) plans

-

Committing to clear timelines and advance notice before any collections resume

This is a good start, Shafroth said, but Social Security recipients need more than just rhetoric. They need real, enforceable protections.

The issue affects tens of thousands of older borrowers living on fixed incomesmany of whom are already navigating financial strain from medical expenses, housing costs, and rising inflation. Advocates warn that resuming offsets without reform would amount to penalizing poverty.

As of today, no timeline has been given for when or if collections will restart.

#Education #Department #backs #plan #seize #Social #Security #defaulted #loans