In just a few months, the UK’s corporate criminal liability offence of Failure to Prevent Fraud (FTPF) comes into force. Modelled on the framework of the Failure to Prevent Bribery offence, FTPF imposes strict liability on “large organisations” for specified fraud offences committed by an “associated person” which includes; employees, subsidiaries, or agents acting on their behalf.

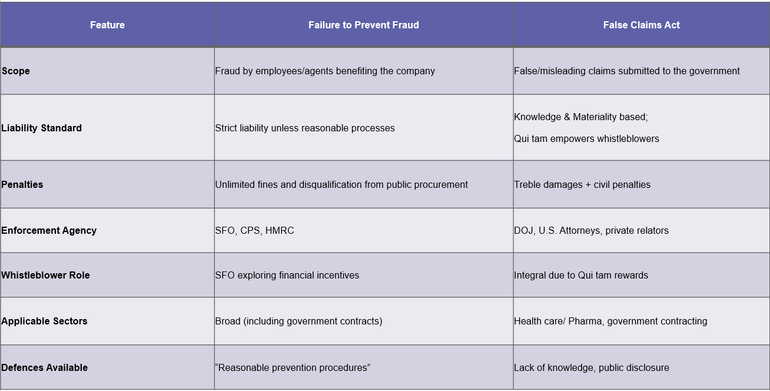

The offence closely mirrors the principles of the US False Claims Act (FCA), particularly in its application to fraud in government contracting and the protection of public funds. However, the UK regime goes further as liability arises irrespective of senior management’s knowledge or involvement. The sole defence is for the organisation to demonstrate that it had “reasonable procedures” in place to prevent the fraud. By contrast, the FCA requires a company to knowingly submit or cause the submission of false claims to the US government.

A defining feature of the FCA is the Qui tam provision, which empowers whistleblowers to bring claims on behalf of the government and share in any financial recovery. Although the UK currently lacks an equivalent mechanism, the Director of the Serious Fraud Office (SFO) has publicly called for the introduction of financial incentives for whistleblowers, which would align the UK regime more closely with the FCA.

The SFO has made clear that enforcement of FTPF will be a strategic priority. As the Director recently warned:

“Come September, if [companies] haven’t sorted themselves out, we’re coming after them. That’s the message I’ll be delivering. I’m very keen to prosecute someone for that offence.”

Given the offence’s extra-territorial reach, broad definition of “associated person,” and the requirement for strong compliance controls, organisations should urgently review and strengthen their anti-fraud controls to ensure they meet the statutory threshold of “reasonableness.”

Comparison with the False Claims Act

How Companies Are Affected

From September 1, 2025, large companies with UK operations will face increased exposure under the FTPF offence. This is especially relevant for companies operating in high-risk sectors such as defence, healthcare, infrastructure, and technology.

To trigger liability, there must be a UK nexus to the fraudulent conduct. A US company could face prosecution if:

- A UK-based employee commits fraud for the company’s benefit;

- An employee or associated person outside the UK commits fraud that occurs in the UK;

- The victim of the fraud is located in the UK.

Importantly, UK prosecutors do not need to prove senior management involvement. They only need to show that the company benefited from the fraud and failed to implement adequate prevention procedures. This places significant responsibility on in-house legal, compliance, and procurement teams to ensure that fraud risks are actively managed across all relevant business functions.

Compliance as a Shield

The key question under the new offence is no longer “Did you know?” but “Did you try to prevent it?” The UK Government’s official guidance [here] outlines what constitutes “reasonable procedures.” These should be:

- Proportionate to the company’s size and fraud risk.

- Implemented in practice and not just on paper.

- Regularly reviewed and updated where necessary.

Five Steps Companies Should Take Now

With enforcement just months away, legal and compliance teams should act swiftly. Key Actions include:

- Conducting or updating fraud risk assessments focusing on UK-linked operations and contracts;

- Aligning internal policies with the UK Government’s April 2024 guidance;

- Training staff, particularly those involved in UK-facing procurement, sales, and government contracting;

- Auditing and monitoring high-risk third parties, including agents, intermediaries, and joint venture partners;

- Embedding compliance obligations into bidding and commercial processes.

Take Away

The UK’s tougher stance on corporate fraud demands immediate attention. Companies that delay preparation risk serious exposure under the new regime.

If you wish to discuss any aspect of this alert further, please contact Matthew Banham, Teddie Arnold, Christopher Robertson, or your usual Seyfarth contact.

#False #Claims #Act #Britain #Preparing #Failure #Prevent #Fraud #Offence