Insurance companies charge homeowners twice as much for having a wower credit score

August 12, 2025

-

Homeowners with low credit scores pay nearly $2,000 more per year for insurance than identical neighbors with high scores, study finds.

-

Credit penalties often exceed the cost impact of living in high natural disaster risk areas.

-

Consumer advocates urge states to ban credit score use in pricing homeowners insurance.

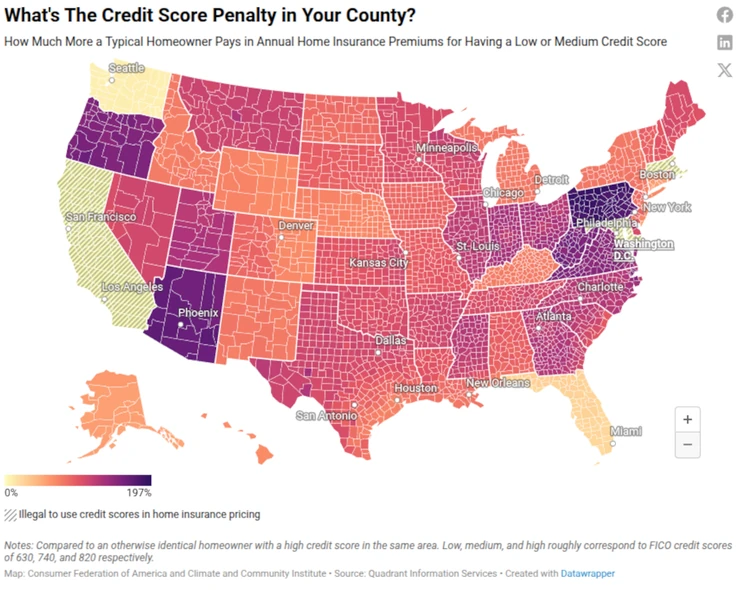

A new report from the Consumer Federation of America (CFA) and the Climate and Community Institute (CCI) says credit scores play an outsized role in determining homeowners insurance premiums often more than climate-related risks. The studyfound that a typical homeowner with a low credit score pays nearly twice as much about $2,000 more annually as an identical neighbor with a high score.

Using premium data from virtually every U.S. ZIP code, researchers discovered that the credit penalty often exceeds the cost of living in high-risk disaster zones. In fact, a homeowner with a low score in one of the nations safest regions can expect to pay the same as a high-score homeowner in a much riskier area. Even homeowners with medium credit scores roughly equivalent to a 740 FICO score pay nearly $800 more per year than those with top-tier credit.

It’s unfair, advocates say

Consumer advocates say the practice is unfair, penalizing people who maintain safe homes but have average or poor credit. Homeowners who have done everything right are still getting hit with higher premiums just because of their credit scores, said Sharon Cornelissen, CFAs Director of Housing.

Insurers claim that the price of premiums provides an effective and efficient signal to people about their climate risk and the need to mitigate that risk. These findings, however, demonstrate that insurers themselves obscure these supposed signals with the use of other potentially discriminatory variables in setting premium prices, CFA said.

The report also challenges insurers claims that premiums primarily reflect climate risk, arguing that the use of credit data masks those signals and may be discriminatory. The authors are urging state lawmakers to ban credit score use in setting premiums a policy already in place in California, Maryland, and Massachusetts and to require insurers to publicly disclose pricing models.

The largest penalties for low credit were found in Pennsylvania, Arizona, Oregon, and West Virginia. In 23 states, a low score roughly equivalent to a 630 FICO results in at least double the premium charged to high-score homeowners.

#Report #credit #scores #double #home #insurance #costs #outweighing #disaster #risk